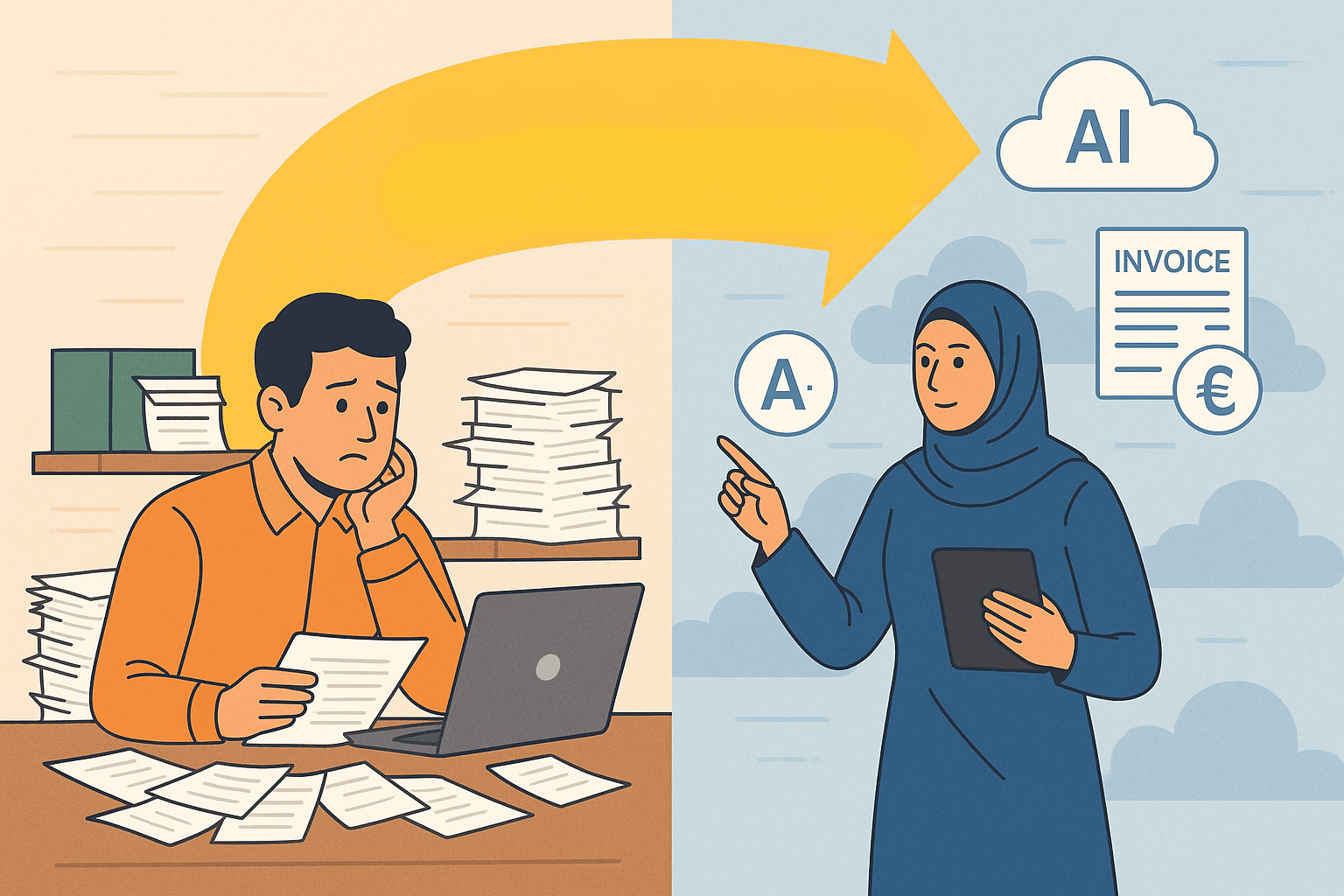

From Manual to Digital: A Shift

Most small businesses in Egypt and throughout the Middle East still use paper receipts, handwritten invoices, or basic digital record-keeping tools such as Excel spreadsheets. According to an official 2022 report issued by the Egyptian Ministry of Communications and Information Technology, nearly 80% of Egyptian SMEs have not fully adopted integrated digital accounting solutions, reflecting a high reliance on manual processes.

Digital Accounting Adoption Among Egyptian SMEs

Source: Egyptian Ministry of Communications and Information Technology (2022)

Key Finding: Nearly 80% of Egyptian SMEs have not fully adopted integrated digital accounting solutions, indicating significant room for digital transformation in the sector.

Ahmed, a small shop owner in Cairo, spends his evenings filtering through piles of receipts to find one missing document. As the piles grow, so does his frustration. Every minute spent searching is another minute lost that could help his business grow. Every delay makes it harder to keep up with competitors.

Relying on manual financial processes slows down small businesses and creates long-term risks like more errors, lost revenue, and trouble keeping up with new regulations. Studies show that manual data management often leads to more mistakes and delays, which can hurt a business's stability and growth. That's why digital transformation is now essential for small businesses that want to stay competitive, improve accuracy, and keep up with changing markets and regulations.

The Challenge: Stuck in a Manual Loop

Manual processes may feel "safe," but they mask real problems:

- ?? Hours spent typing invoices manually

- ?? Missing or duplicated data

- ?? Delayed payments and lost receipts

- ?? Poor visibility of cash flow

Most entrepreneurs in Egypt and the Middle East spend their valuable time looking for financial documents and hand-checking records, often staying up late to complete what needs to be done. While this might seem manageable at first, it requires substantial effort and brings real risks.

According to research by KPMG (2021), small businesses can lose as high as 20% of their monthly revenue due to manual financial work errors and inefficiencies.

These same issues cause:

- Delays in payments

- Unhappy customers

- Increased threat of fines for non-compliance with new e-invoicing regulations

Over time, these problems make it harder for businesses to adjust, plan for the future, and compete in a digital world. That's why transitioning to digital financial tools is not just a good idea�it's a step toward lowering risk, remaining compliant, and building a stronger future.

While businesses embracing automation technologies experience quantifiable improvements in operational efficiency, customer service quality, and market growth, organizations still relying on manual operations are becoming increasingly vulnerable to reduced competitiveness, loss of market share, and failure to meet changing customer expectations�threatening their long-term viability.

The Opportunity: Digital Tools for a Smarter Future

The good news? You can start digital transformation now without a big investment. With Raqmly, you can begin for less than the cost of a paper ledger each month. There's a free trial, affordable plans, and no setup fees�making it easy and low-risk for business owners to try digital tools and see the benefits firsthand.

How Digital Tools Transform Your Business

Using advanced digital tools in financial management can make businesses run more efficiently and reduce mistakes. Automation technologies like OCR (Optical Character Recognition) and AI turn paper invoices into digital records with minimal effort.

Automated invoice processing:

- Extracts important details from scanned documents

- Checks data for accuracy automatically

- Cuts down on common errors

- Frees staff from data entry to focus on valuable work like financial analysis and business growth

One Raqmly client saved several hours each week after switching to automated invoice processing, allowing them to focus on growing their business instead of paperwork.

The Process is Simple:

- ?? Scan a paper invoice using your phone

- ? Instantly convert it into a digital record

- ? No manual typing needed

- ?? Reduced errors automatically

Governments in Egypt are encouraging this move to e-invoicing and digitization, making now the perfect time for small businesses to initiate this transformation.

How Raqmly Fits In: Smart, Simple, Arabic-First Automation

Raqmly is uniquely designed for small businesses in Egypt and the Middle East, focusing on local challenges. By combining Arabic OCR and advanced AI, Raqmly automates invoices, works seamlessly in Arabic, and fits perfectly with existing business workflows�all without complex integration or high costs.

Success Story: Ali's Market

Ali's Market, a family-owned business in Cairo, cut data entry tasks by 70% within just one week of using Raqmly, allowing them to focus more on their customers and less on paperwork.

What Sets Raqmly Apart

Unlike competitors offering generic solutions without Arabic optimization, Raqmly is dedicated to local needs. Where others struggle with language and integration complexities, Raqmly offers straightforward solutions specific to Arabic-speaking businesses, ensuring a smoother transition to digital operations.

Easy Integration: To ease the transition, Raqmly connects effortlessly with existing systems through simple API endpoints or works as a standalone application, allowing business owners to gradually integrate digital tools without disrupting their current operations.

Key Benefits

⏱️ Save Time

✓ Minimize Errors

📋 Stay Compliant

🌍 Arabic-First

Raqmly is the only AI-powered digital assistant built with an Arabic-first approach for small and medium businesses in Egypt and the Middle East. This helps Arabic-speaking users manage their business flow smoothly and remain compliant with local rules and regulations.

Dedicated Support

Phone, chat, and email support available in both Arabic and English, ensuring business owners can reach for help quickly and easily when moving to digital tools.

The Future: Data-Driven and AI-Assisted

The future of doing business in Egypt will be truly digital, automated, and powered by artificial intelligence.

The transition from manual to digital processes is not merely a technical upgrade but a foundational strategy for small businesses seeking to achieve:

- Operational efficiency

- Financial management accuracy

- Regulatory compliance

Digital tools such as automated invoice processing and Arabic-first AI solutions directly address documented inefficiencies and risks of manual systems, including:

- ? Reduced errors

- ?? Preserved revenue

- ?? Improved compliance with evolving legislative mandates

The adoption of such technologies aligns closely with Egypt Vision 2030's sustainable development agenda, reinforcing national priorities for economic modernization and enterprise growth.

The Bottom Line

Embracing digital transformation enables small and medium-sized enterprises to better navigate market dynamics, enhance their competitive standing, and secure long-term organizational sustainability within an increasingly digital economy.

Get Started with Raqmly Today

Simple Onboarding Process

- Sign up in one minute on our website

- Follow the guided setup � step-by-step walkthrough (only 2 minutes)

- No credit card required for your free trial

- Access training resources to build confidence with the tools

Whether you want to integrate slowly or start right away, the process is simple from the beginning.

No credit card required � 2-minute setup � Cancel anytime

Frequently Asked Questions

What is digital transformation for small businesses?

Digital transformation shifts businesses from labor-intensive manual entries to the efficiency of single-tap scans, turning tedious paper-based tasks into efficient digital ones. This saves time and brings great improvement in accuracy, enabling businesses to focus on growth and innovation.

Why is digital transformation important for Egyptian SMEs?

It helps them compete, comply with new e-invoicing regulations, and operate more efficiently�all crucial factors for survival and growth in today's market.

What does Raqmly do?

Raqmly automates invoice processing using Arabic OCR and AI, helping small businesses go paperless while maintaining full support for Arabic documents and local compliance requirements.

Is it expensive to undertake digital transformation?

Not at all. Raqmly offers affordable plans that grow with your business, starting at less than the cost of a paper ledger each month.

Does Raqmly support Arabic documents?

Yes! It's built to handle Arabic invoices and receipts natively, making it perfect for businesses in Egypt and the Middle East.

How do I start using Raqmly?

How do I get started with Raqmly?

Simply sign up for a free trial. The entire process takes less than 2 minutes and requires no credit card.

Ready to transform your business? Join hundreds of Egyptian SMEs already saving time and reducing errors with Raqmly.